Local Authority Affordable Purchase Scheme

Affordable Purchase Scheme

The Local Authority Affordable Purchase Scheme (LAAPS) helps eligible applicants buy a home at a discount to the home’s market price. It aims to help people (individuals, couples and larger households) buy their own home when they may not otherwise have been able to.

Dublin City Council will provide what’s known as an ‘Affordable Dwelling Contribution’, a monetary contribution, towards the cost of purchasing the house, which reduces the price the home purchaser pays. The Affordable Dwelling Contribution is represented as an equity share, a percentage share, in the home. This equity share is equal to the difference between the open market value of the home and the reduced price paid by the purchaser. So, if Dublin City Council takes a 20% equity share, the purchaser will benefit from a 20% discount on the open market price.

The purchaser will pay the ‘Affordable Purchase Price’, the price after Dublin City Council’s Affordable Dwelling Contribution is subtracted from the market value. The affordable purchase price will be calculated using the applicant’s income, savings and the terms and conditions of the specific affordable housing scheme they are applying for.

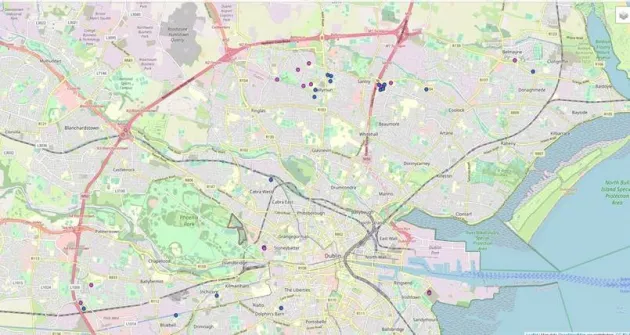

The schemes are located across Dublin City Council’s administrative area. We are scheduled to deliver over 1,400 affordable purchase homes as part of our current housing delivery programme. Where Affordable Purchase and Cost Rental homes will be delivered in Dublin City.

Ahead of the completion of housing developments, their specific details will be advertised by Dublin City Council on our Website, Social Media platforms, and in the Newspapers in advance of the open date for applications. Affordable Housing Details Here

Montpelier Development Computer Generated Imagery.

Frequently Asked Questions

Eligibility

To be eligible to apply for an affordable home you must satisfy the following criteria:

- You must be over 18 years of age;

- You must be a First Time Buyer or meet the exceptions under the Fresh Start Principle, or you own a home which is not suited to your current accommodation needs due to its size;

- You have not previously purchased or built a dwelling in the Republic of Ireland for your own occupation. Exceptions apply to Fresh Start Principle applicants.

- Each person included in the application must have the right to reside in the State;

- The affordable home must be the household’s normal place of residence;

- Your purchasing power (mortgage capacity + deposit + relevant savings) must not exceed 95% of the open market value of the property.

- You must have a minimum deposit of 10% of the purchase price.

Each Scheme will have different income limits depending on the cost and location of the homes. In general, the income limit for an affordable dwelling is 85.5% of the market value of the property divided by 4.

When developments are advertised, the maximum gross income for each dwelling in the development will be shared along with a calculator to assist with determining your financial eligibility for the Affordable Homes.

For further information on assessable and non-assessable forms of income for your application, please review our Income Assessment Policy.

A First-Time Buyer is someone who has never previously purchased or built a dwelling in the State for their occupation and does not own or is not beneficially entitled to an estate or interest in, any dwelling.

No, applicants living in any county in the Republic of Ireland can apply. However, should DCC receive more eligible applications than there are properties, 30% of the properties will be issued to eligible applicants who have provided evidence of being or have been a resident in the administrative area of Dublin City Council for a minimum period of 3 years in accordance with the DCC Scheme of Priority. It should also be noted that the affordable home must be your principle place of residence.

Dublin City Council require documentary evidence to confirm the applicant(s) is a/are First Time Buyer(s). This can be proved through Revenue Help to Buy (HTB) approval obtained from the Revenue Commissioners or an affidavit stamped by a solicitor swearing to this.

MyAccount PAYE applicants:

Print out from Revenue portal confirming names of applicant(s) and maximum entitlement under the scheme.

ROS self-assessed applicants:

Print out from Revenue portal confirming names of applicant(s) and maximum entitlement under the scheme.

In order to be eligible to claim HTB, a qualifying loan must be taken out on the qualifying residence, with a qualifying lender. As of the 11th October 2023, the combined value of your mortgage and your affordable dwelling contribution can now be used to calculate your loan to-value ratio in a HTB application. The loan-to-value ratio must be a minimum of 70% of the full market value.

Please note that in the case of a joint application, your application can only be considered as a “first time buyer” application if both applicants are buying a house for the first time. Therefore both parties need to be named on below documentation either together on same documentation or separate documentation for each applicant.

The Fresh Start Principle applies to applications for State affordable housing and loan schemes. This means that the following people may be eligible to apply for an affordable home:

- Applicant(s) who previously purchased or built a residential property but are divorced/separated or otherwise and have left the property and divested themselves of their interest in the property. Where a couple was in a relationship but not married, and the relationship has ended, the Fresh Start Principle can apply;

- Applicant(s) who previously purchased a residential property, but has been divested of this through insolvency or bankruptcy proceedings, are eligible to apply.

- A further exception may apply in the case of an applicant who owns a dwelling which, because of its size, is not suited to the current accommodation needs of the applicant’s household.

Documentary evidence will need to be provided with your application in the form of a Separation Agreement, Court Order, Affidavit from a solicitor confirming the separation or divorce, Solicitors letter confirming the applicant has exited insolvency or bankruptcy.

Yes, you are eligible to apply if you currently live in the Republic of Ireland and have a legal right to reside and work in the State:

- All Irish citizens, currently living in Ireland, are automatically legally resident;

- UK citizens, currently living in Ireland, will be regarded as being legally resident in Ireland (this accords with the Common Travel Area requirements);

- All EU/EEA citizens who are currently legally resident in the State are eligible to apply;

- Non-EEA/EU citizens who are currently legally resident in the State are eligible to apply, provided they have a valid Irish Resident Permit. Please submit a copy of your Irish Resident Permit (IRP or GNI Stamp 4) card, indicating which stamp/permissions you have.

Single/joint applicants must provide a copy of their Irish Resident Permit (IRP or GNI Stamp 4) card, indicating which stamp/permissions they have.

My Application

Dublin City Council have a number of developments in progress in the delivery of affordable homes at a variety of locations. These can be viewed in Developments in Progress with information on their expected completion date. Homes in the wider Dublin area and beyond (not under the remit of Dublin City Council) will be advertised here homes not under remit of Dublin City Council.

AFFORDABLE_SCHEMES Map (dublincity.ie)

Affordable Purchase Scheme | Cost Rental Scheme (affordablehomes.ie)

No, there is no waiting list for dwellings being delivered through the Affordable Purchase Scheme. When the homes are nearing completion and therefore ready for applications, Dublin City Council will advertise them in advance of the application portal opening. The advertisements will appear in the Newspapers, on our Website, and across our Social Media platforms. Properties will be allocated to valid and eligible applicants who apply via the application portal in accordance with Dublin City Council’s Scheme of Priority for Affordable Dwelling Purchase Arrangements.

Applications will only be accepted through our online application portal https://affordablehomes.dublincity.ie. Potential applicants can register for an account in advance of the opening date and we encourage you to do this. You can access this website with login details used for the DCC Citizen Hub portal. Please ensure you have the correct email and password details in advance of the application portal going live.

The public will be notified of available affordable homes at least 2 weeks in advance of the application portal opening. The portal will remain open for 3 weeks. Properties will be allocated on a first come first served basis in accordance with the eligibility criteria set out in Dublin City Council’s Scheme of Priority.

The property you choose must be within your purchasing power and suit your household size in line with the local authority's Scheme of Priority. Full information on the priority given to each household will be found in the Scheme of Priority for each development and will be available to view on the local authority's website. Priority will be given on the following basis:

| DWELLING TYPE | MEETS ACCOMMODATION NEEDS OF: |

|---|---|

| Three-bedroom dwelling | 2 or more-person household |

| Four-bedroom dwelling | 3 or more-person household |

Yes. In some of our developments there will be different home types and sizes. If applicable, you can choose to apply for more than one property.

In such a scenario you will be considered for the most expensive house type that you can afford first, and if successful your application for any other homes will be given no further consideration in the assessment process.

For example; if you apply for a 3-bedroom and a 2-bedroom apartment we will assess the applications for the larger or more expensive home first. If you can afford and are prioritised for the 3-bedroom apartment, your application for the 2-bedroom apartment will not be considered. Similarly if you apply for two differently priced 2-bedroom homes, say a mid-terrace and an end-of-terrace house, you will be prioritised for the most expensive one you can afford.

It will not be possible to apply for homes in order of preference so you should only apply for a home that you would like to buy.

- Register for an account on our Affordable Homes Portal here in advance of the application opening. You will require an account to apply for the scheme on the online portal. You can access this website with login details used for the DCC Citizen Hub portal. Please ensure you have the correct email and password details in advance of the application portal going live

- Review our FAQ section for further information on the scheme;

- Familiarise yourself with the documentation required and gather all relevant documents in advance. We strongly advise to have the relevant documents scanned to your device whereby you will be completing the application form, with them named appropriately and visibly clear;

Please be aware you can only upload documents in the following formats: .jpeg, .jpg, .jpe, .pdf, .png -

Secure your Mortgage Approval in Principal letter before submitting an application. If you do not have this before applying, you can still submit an application, however you must have this before the date the portal closes;

Please note: At present we are only accepting applicants with Mortgage Approval in Principal with the following financial providers - AIB, PTSB, Bank of Ireland. EBS, Avant Money, Haven Mortgages and Community Credit Union Ltd. You may also be able to use the Dublin City Council Local Authority Home Loan (LAHL).

- Keep an eye on our website and social media channels for development-specific information such as pricing and income limits which will be advertised at least two weeks before the application portal goes live;

On the day of application, ensure you are applying on a reliable device with stable WIFI connection/internet access.

Please be aware that applications must include all the required documentation. It is the responsibility of each applicant to ensure that all required information and documentation is submitted at the time of application. Failure to do so may affect the date and time stamp allocated to your application.

The following information will be required:

- Personal details (e.g. name, date of birth, PPSN),

- Confirmation that you are a First-Time buyer or that you qualify under the Fresh Start principle,

- Evidence of the total gross annual income for your household for the preceding 12 months,

- Evidence of your 10% deposit and any savings, i.e., bank statements,

- Evidence of your right to reside in the State,

- Evidence of how you intend to finance the property, i.e., Mortgage Approval in Principle letter.

A checklist of acceptable documents can be found here:

The online application process itself is comprehensive. To efficiently progress through each stage you should have the most up-to-date version of these documents scanned and saved in the required format in advance of the portal opening date.

Link to Doc checklist open in separate tab – Documentation Checklist

It is strongly recommended that applicants have their Mortgage Approval in Principle (MAIP) in place prior to applying for an Affordable Purchase Home. An applicant will be required to input the amount they are approved for (this can be determined by your mortgage provider, mortgage calculator, or on the Mortgage Approval in Principle letter) and provide evidence of same

If an applicant does not provide evidence of MAIP with their initial application, they will have only until the closing date for applications to submit it, after which the online application portal will close. On closing of the application portal Dublin City Council will review, assess and prioritise the applications. Only those applicants who have submitted evidence of MAIP will be considered for a provisional offer as it will not be possible to progress the sale of a home without this.

Applicants with Mortgage Approval in Principle from the following lending institutions can be considered under the Affordable Purchase Scheme:

Alternatively, if you have been unable to secure a mortgage from any of the lending institutions above you may be able to use a Local Authority Home Loan (LAHL) to purchase your home, subject to the terms and conditions of the loan. Further information can be found here.

Before beginning to assess whether the applicant is eligible for an affordable dwelling purchase arrangement, Dublin City Council first needs to establish the validity of the applications received. A valid application is:

- An application received within the time set out by Dublin City Council;

- An application submitted through the correct Dublin City Council online application portal;

- An application that has been accompanied by all the required documentation;

- Where the applicant is married, in a Civil Partnership or in an intimate committed relationship with a partner with whom she/he intends to live in the affordable dwelling, the applicant must apply with their spouse/partner.

It is the responsibility of each applicant to ensure that all required information and documentation is submitted at the time of application. Failure to do so may deem your application invalid or at the least affect the date and time stamp allocated to your application.

Dublin City Council will review the completed applications to determine their validity. Only valid applications (those who have submitted all the required documentation) will be further assessed to determine eligibility.

All eligible applications will then be assessed in accordance with Dublin City Council’s Scheme of Priority for Affordable Dwelling Purchase Arrangements; with the following considerations:

- The property being sold must suit your household’s accommodation needs:

- For 3-Bed dwellings where number of eligible applicants exceed available units, households comprising of 2 or more persons will be prioritised;

- For 4-Bed dwellings where number of eligible applicants exceed available units, households comprising of 3 or more persons will be prioritised

- Where, having applied the above criteria, the number of eligible applications still exceed the number of available dwellings, priority will be given based on the date and time of fully completed applications being submitted, i.e. first come first served basis;

- If there is still an excess of eligible applications for the number of dwellings following the assignment of the above criteria, 30% of properties will be allocated to eligible applicants who provide evidence of a minimum of 3 years continuous residency in the administrative area of Dublin City Council. Those who meet the required accommodation needs and residency requirements will then be entered into a randomised lottery where the successful applicants will be selected.

If an applicant applies for more than one property they will be considered for the most expensive home that they can afford. For example it will be possible to apply for both a 2-bedroom and a 3-bedroom home, however if the applicant can afford a mortgage on the larger home they will be prioritised for the 3-bedroom and removed from consideration for the 2-bedroom home. Similarly if an applicant applies for two differently priced 3-bedroom homes, say a mid-terrace and an end-of-terrace, they will be prioritised for the most expensive one they can afford.

In accordance with the Affordable Housing (No. 2) Regulations 2023 Dublin City Council’s Scheme of Priority for Affordable Dwelling Purchase Arrangements was approved by the Elected Members of Dublin City Council on 6th November 2023. It outlines the methodology to be applied to determine the order of priority accorded to eligible households where the demand by eligible applicants exceeds the number of dwellings available. The Scheme of Priority will apply in the event where there are more eligible applicants than affordable homes available.

In summary, where there are more eligible applicants than homes available, Dublin City Council will apply the criteria below:

- Households of at least 2 persons will be given priority for three-bedroom homes;

- 70% of the homes will be assigned in the order in which the applications were received i.e. first come, first served;

- The remaining 30% of homes will be assigned via randomised lottery, to eligible applicants who are or have been resident in the administrative area of Dublin City Council for a minimum of three years.

Persons who may be accepted as part of an applicant’s household:

- The partner (aged 18 or over) of the applicant, including married, civil partners, unmarried and same sex partners;

- A person that Dublin City Council accepts as suitable for inclusion on the basis of an accepted commitment or dependence, such as being a designated carer in receipt of Carer’s allowance;

- Dependent children ordinarily living with the applicant on a full-time or part-time basis. The applicant may be asked to provide some evidence of the dependency and residency.

- Persons residing with the applicant who, in the opinion of the Executive Manager should be considered a member of the applicant’s household, regard being had to all circumstances including the length of time resident with applicant.

Yes, you will require a solicitor to do the conveyancing (legal work involved in buying a property). You can use the Law Society’s website to find a solicitor in your area.

After the online application portal closes and Dublin City Council complete the assessment process, successful applicants will be contacted by email as soon as possible. Dublin City Council will then instruct the developer/nominated sales agent to contact you to progress your application.

Once all homes have been allocated, the unsuccessful applicants will be notified via email.

What will I pay

This is the price that the affordable home might reasonably be expected to be sold for on the open market. It is known as the market value or the open market value. The open market value will be initially set by Dublin City Council.

Dublin City Council, in line with the Affordable Housing Regulations, will set a minimum price that the homes can be sold for. The affordable purchase price will be calculated based on the purchasing power of eligible applicants. The price will vary for each purchaser as it is based on their income, savings and purchasing power.

Your purchasing power will be calculated as the combined total of:

- Maximum mortgage capacity (4 times your gross household income) plus;

- A minimum deposit of 10% of the affordable purchase price plus;

- Relevant savings (these are savings in excess of your deposit plus €30,000)*.

*If you have savings above a certain amount, you may not qualify for the affordable purchase scheme. You can have the money required to cover the deposit for the home and an additional €30,000. Anything above this is added to your purchasing power. And, if this purchasing power goes above 95% of the market value of the property you are not eligible for the scheme.

Dublin City Council will provide a monetary contribution known as an Affordable Dwelling Contribution that facilitates the purchase of homes by an eligible applicant.

The Affordable Dwelling Contribution is the difference between the combined total of the purchaser’s deposit and maximum mortgage capacity (and savings where relevant) and the market value of the home on the date of offer.

For example

| Label | Description | Value |

|---|---|---|

| A | Market Value of the Home | €390,000 |

| B |

Applicant’s Purchasing Power Mortgage Capacity + Deposit + Relevant Savings (€292,000 + €32,444 + 0) |

€324,444 |

| C | Affordable Dwelling Contribution (A – B) | €65,556 |

| D | DCC Equity Share (C ÷ A) x 100 | 16.81% |

The Equity Share is simply the Affordable Dwelling Contribution expressed as a percentage. It is the stake that Dublin City Council will take in your home that covers the reduced price. This equity share will be determined by the reduced price of the property and the applicant’s purchasing power. For example if you buy a home at a 20% discount, Dublin City Council will have a 20% stake in your home. This does not establish Dublin City Council as a co-owner of your home. The Equity Share will be written into the Affordable Dwelling Purchase Arrangement (ADPA).

If your application is successful and you are approved to purchase an affordable home you will enter into a legal contract with Dublin City Council known as the Affordable Dwelling Purchase Arrangement. The ADPA sets out the terms and conditions under which Dublin City Council is providing the Affordable Dwelling Contribution and that we will acquire an equity share in the property. Each successful applicant will enter into an ADPA with Dublin City Council prior to the closing of the purchase of their affordable home

The agreement covers the obligations of the purchaser and Dublin City Council and makes provision for the registration of the agreement with the Registry of Deeds/Land Registry. The agreement will also set out how and when you, the homeowner, can make redemption payment(s) to reduce Dublin City Council’s affordable dwelling equity share as well as the conditions under which the City Council may seek redemption of our affordable dwelling equity.

The Affordable Dwelling Contribution (Dublin City Council’s equity share in your property) can be bought out by you at a time of your choosing but there will be no requirement to do so. The total amount repayable in respect of the Affordable Dwelling Contribution to remove the City Council’s equity share from the property will depend on the future open market value of the home and the timing of the repayment(s).

You can decide when to make redemption repayments on Dublin City Council’s equity share, subject to a minimum repayment amount of €10,000. Certain events can trigger the equity share to be repaid, for example, when you decide to sell your home or in the event of your death.

Dublin City Council may not seek repayment of our affordable dwelling equity for a 40 year period. After 40 years we may request full repayment of our equity share in your home if it has not previously been paid down through redemption payments. This is referred to as the long stop date.

There are certain events which will trigger the local authority requesting their equity share to be redeemed. This is called a ‘Realisation Event’. In most cases, this event is triggered when a property is sold by the homeowner. A percentage of the sale price, equivalent to the percentage equity share, must be paid to the local authority.

Dublin City Council can demand the repayment of the Affordable Dwelling Equity by serving a ‘Realisation Notice’ on the homeowner on the occurrence of one of the below certain ‘Realisation Events’:

- The Long-Stop date of 40 years from the date of purchase of the property has expired without the purchaser having paid back the full equity share;

- Where the purchaser(s) die;

- Where the purchaser(s) commit an act of bankruptcy, or is adjudicated as bankrupt;

- A mortgagee, incumbrancer or receiver gains possession of the affordable dwelling;

- The dwelling becomes subject to an order or process for compulsory purchase;

- The dwelling is demolished or destroyed, whether by fire or otherwise or is damaged so as to materially affect its market value;

- The dwelling is abandoned or is no longer the principal primary residence of the purchaser(s);

- The dwelling is sold;

- Where there is a material breach of a covenant in the affordable dwelling purchase arrangement;

- The purchaser(s) is found to have deliberately misled the Local Authority in respect of any material fact regarding eligibility or priority in making their application.

A Realisation Notice will specify a period (not shorter than three months commencing on the service of the notice) after which the Local Authority will be entitled to realise the affordable dwelling equity. The procedure for this arrangement will be clearly set out in the ‘Affordable Dwelling Purchase Arrangement’.

You will require 10% of the purchase price and not the open market value of the property.The Help to Buy Scheme (HTB) operated by the Revenue Commissioners can be utilised towards this deposit amount where the applicant is eligible for the HTB Scheme.

The Help to Buy Scheme was introduced to assist first-time buyers in purchasing a new-build or self-build property with a value of €500,000 or less. Eligible buyers can receive a refund of income tax and Deposit Interest Retention Tax (DIRT) paid in Ireland over the previous four tax years, up to a maximum amount of 10% of the purchase price of the property or €30,000, whichever is the lesser. To apply for HTB, the steps are as follows:

1. Application Stage – Submit application via myAccount or ROS. Once confirmed you are tax compliant, an Application Number will be provided;

2. Approval Stage – Once your application is approved, you will be advised of the maximum amount available to you *this is the document required to verify your First Time Buyer Status*

3. Claim Stage – Once you find a suitable property, you will need to provide the property and builders details and evidence of mortgage such as a signed copy of the contract;

4. Verification Stage – The information and documentation provided during the Claim Stage will be verified by the qualified contractor; If everything is in order, your application will progress to the next stage;

5. Payment & Usage Stage – Once your application is fully processed and verified, the tax rebate will be paid. The refund is paid directly to the builder for a new property purchase.

No. The First Home Scheme is a separate shared equity scheme with different qualifying criteria and cannot be used in conjunction with the Affordable Purchase Scheme.

Yes. Your Solicitor will calculate how much stamp duty is due. This amount is payable by you to the Revenue Commissioners.

If you buy an affordable home in a multi-unit development you will have to pay an annual service charge.

A multi-unit development (mostly apartment blocks) is a development of at least 5 residential units that share facilities, amenities and services. They can also be known as managed estates.

The common areas of a multi-unit development are owned and managed by the Owner’s Management Company (OMC). These common areas include external walls, roofs, entrance halls, landings, lifts, staircases, sewers etc.

The OMC must set-up an annual service charges scheme to pay for:

- The maintenance, insurance and repair of common areas within its control

- The provision of common services to unit owners (for example, refuse collection, security, gardening)

Further information can be found here.

General Information

Information on the Affordable Purchase Scheme is set out in the Affordable Housing Act 2021.

The Local Authority Affordable Purchase Scheme is provided to homebuyers who intend to make the property their Principle Private Residence.

If you sell your property you are required to redeem (buyback) the equity share. If you have not already redeemed the equity in your home, you cannot sell the property without written consent of the local authority. This consent should be requested in writing.

To avoid unnecessary delays, notification should be sent when you are putting your house on the market and the notification must include a proposed minimum selling price for the home and any other information necessary for the local authority to consider the request.

Please Note: If you availed of the Help to Buy scheme at the time of purchase please also refer to Revenue for information relating to any claw back of funds that may be owing.