Living City Initiative

Living City Initiative closing date is extended to 31st December 2027.

The Living City Initiative (LCI) is a tax incentive scheme to assist and encourage people to live in the historic inner-city areas of Dublin city. It allows you to claim tax relief for the money you spend on refurbishment or conversion of residential property either as income tax relief (for an owner-occupied residence) or capital allowance (for rented residences).

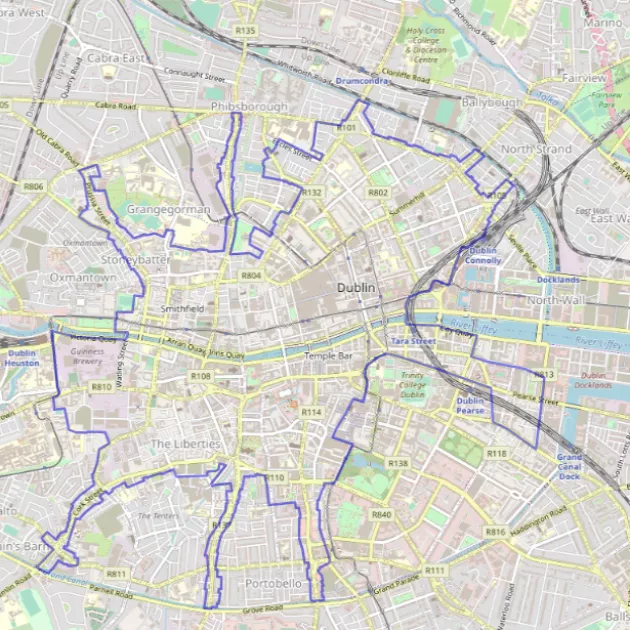

The scheme also encourages the regeneration of retail and commercial districts by enabling you to claim an accelerated capital allowance on money you spend on commercial property refurbishment or conversion. Visit the Special Regeneration Area (SRA) Map to see the locations.

The LCI incentivises you to refurbish, convert, or upgrade existing accommodation or bring derelict or disused properties back into use. For example, you might convert a shop's vacant upper floors into residences or offices or refurbish your home.

The minimum cost of works for qualification for the scheme is €5,000. A property in the scheme can be:

- a house

- apartment

- shop

- any kind of structure and can include all or part of a property

Does my property qualify?

To qualify for the scheme, your property must:

- Have been built before 1915 (does not apply to commercial properties)

- Be located within the designated ‘Special Regeneration Area’ (SRA)

- Cost of the works undertaken are for a minimum of €5,000 (capped at €200,000 relief available for commercial element)

- Works are for refurbishment/ conversion of the property

- Works are undertaken:

- before 31st December 2027 and started after 5th May 2015 for owner-occupied residential relief

- retail commercial relief or 1st January 2017 for rented residential relief

- Works meet the qualifying expenditure criteria

- Works comply with all development requirements such as planning regulations and building regulations

- Conditions for immediate occupation of the property (after works are completed) have been met

What can I claim?

There are three types of tax relief available and the qualifying periods are as follows:

| Owner-Occupier Residential Relief | Commenced on 5th May 2015 |

| Commercial Relief | Commenced on 5th May 2015 |

| Rented Residential Relief | Commenced on 1st January 2017 |

The scheme for all reliefs will end on 31st December 2027. Only refurbishment/ conversion work carried out during the above timeframes will qualify for relief. Further information can be accessed here.

How do I apply?

Residential Applications:

Online application (Consultation unavailable and this is currently under review). Postal applications are also accepted and can be sent to:

Living City Initiative (LCI) Unit

Dublin City Council

Planning & Property Development Department

Block 4, Floor 2

Civic Office, Wood Quay

Dublin 8

Should you have a query regarding your eligibility to apply please:

- Email [email protected]

- Call 01 222 3480

Commercial Applications:

Commercial relief is applied for directly through the Revenue Commissioners and further information can be obtained from Revenue.ie.

What help is available?

A Multi-Disciplinary Advisory Service is available and can assist with a query that you may have.